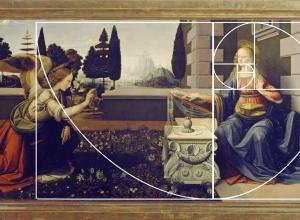

Lisa Schiff at Art Basel giving a talk titled, "How to Reach New Collectors"

Lisa Schiff, the once revered art advisor, has recently come into the spotlight for a lawsuit that accuses her of using her advisory firm to defraud clients in a Ponzi scheme. In the past, Schiff was known to be an advisor to the elite, with clients ranging from Leonardo DiCaprio to major corporations, foundations, and institutions. But her world came crashing down when it was revealed in two lawsuits in May 2023, and another damning document filed this month, that Schiff is claimed to have defrauded over fifty clients for sums in the millions.

The first suit was brought on May 11 of this year. The plaintiffs are real estate heiress Candace Barasch and lawyer Richard Grossman. The duo filed a suit in the New York Supreme Court alleging that Schiff owes them a total of $1.8 million ($900,000 each). The charges include breach of contract, fraud, and conspiracy, among others.

The story goes that in April 2021, Schiff worked with Barasch and Grossman to acquire an Adrian Ghenie painting. Barasch took a 50% share while Grossman and his spouse acquired a 25% interest each. Then, in November 2022, they decided to sell the work with Schiff brokering the deal. Done through Sotheby’s Hong Kong, they sold the work for $2.5 million. Initially, they received $450,000 each as an initial payment, but they never received the remaining $1.8 million from Schiff. Thus by May, when they had yet to receive the money, they filed the suit.

The second suit was also brought by Candace Barasch, this time along with her husband Michael, who claim that Schiff and her advisory, SFA Advisory, had redirected money that was intended for purchases of art. Instead of using it for the intended purpose, they allege that Schiff used the funds to “spoil themselves with luxury travel, shopping sprees, and the like.” It even outlines an entire conversation where Schiff called Barasch to admit that the money was gone.

The lawsuit also outlines many examples of a similar situation: Candace wishes to buy a work of art, she wires Schiff the money for a deposit or for the entire amount, and then after weeks of waiting, the work is nowhere to be seen and the galleries have canceled the sale because they never received a deposit. In one example this is an Ernie Barnes painting from Andrew Kreps Gallery that was $650,000. Candace wires Schiff a deposit of $50,000, but after weeks with no update, Barasch calls the gallery to find out that the deposit was never sent and the sale was canceled. This happens again and again: in one instance it’s an Anicka Yi work that Candace paid Schiff $190,531.23 for; in another it’s $180,000 for a never to be seen Alvaro Barrington work. In all the accounts, Barasch would come to find out that Schiff had never paid the gallery to begin with.

Cut to August 11, 2023: a document filed by Douglas J. Pick shows that the Barasch’s are not the only ones with pending claims against Schiff. Pick is the person that Schiff appointed to liquidate her firm, and he chose Winston Art Group to inventory Schiff’s company. Per the lawsuit, they are working to account for missing inventory that is valued at $1.13 million. In addition, they listed all the plaintiffs that filed claims against Schiff. These claims are all listed as “General Unsecured Claims” which means that the funds were paid by the plaintiffs to Schiff for artworks, and then were never given the works. Brian and Karen Conway allege that Schiff stole $611,500, Thomas and Jeanne Hagerty claim that they are owed $990,000, and Seffa Klein alleges she is missing $506,200. There are eight pages of plaintiffs with varying amounts of claims, and over a hundred artworks that are missing. Whatever happened to the works will hopefully be revealed in a New York court soon.

To see a talk that Lisa Schiff gave at Art Basel about how she acquired new clientele, view the video below.